Business Insurance in and around San Marcos

San Marcos! Look no further for small business insurance.

Insure your business, intentionally

Insure The Business You've Built.

When you're a business owner, there's so much to focus on. You're in good company. State Farm agent John Hadley is a business owner, too. Let John Hadley help you make sure that your business is properly covered. You won't regret it!

San Marcos! Look no further for small business insurance.

Insure your business, intentionally

Cover Your Business Assets

State Farm has been helping small businesses grow since 1935. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a photographer or an insurance agent or you own a music school or a travel agency. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent John Hadley. John Hadley is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Get in touch with State Farm agent John Hadley's team today to get started.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

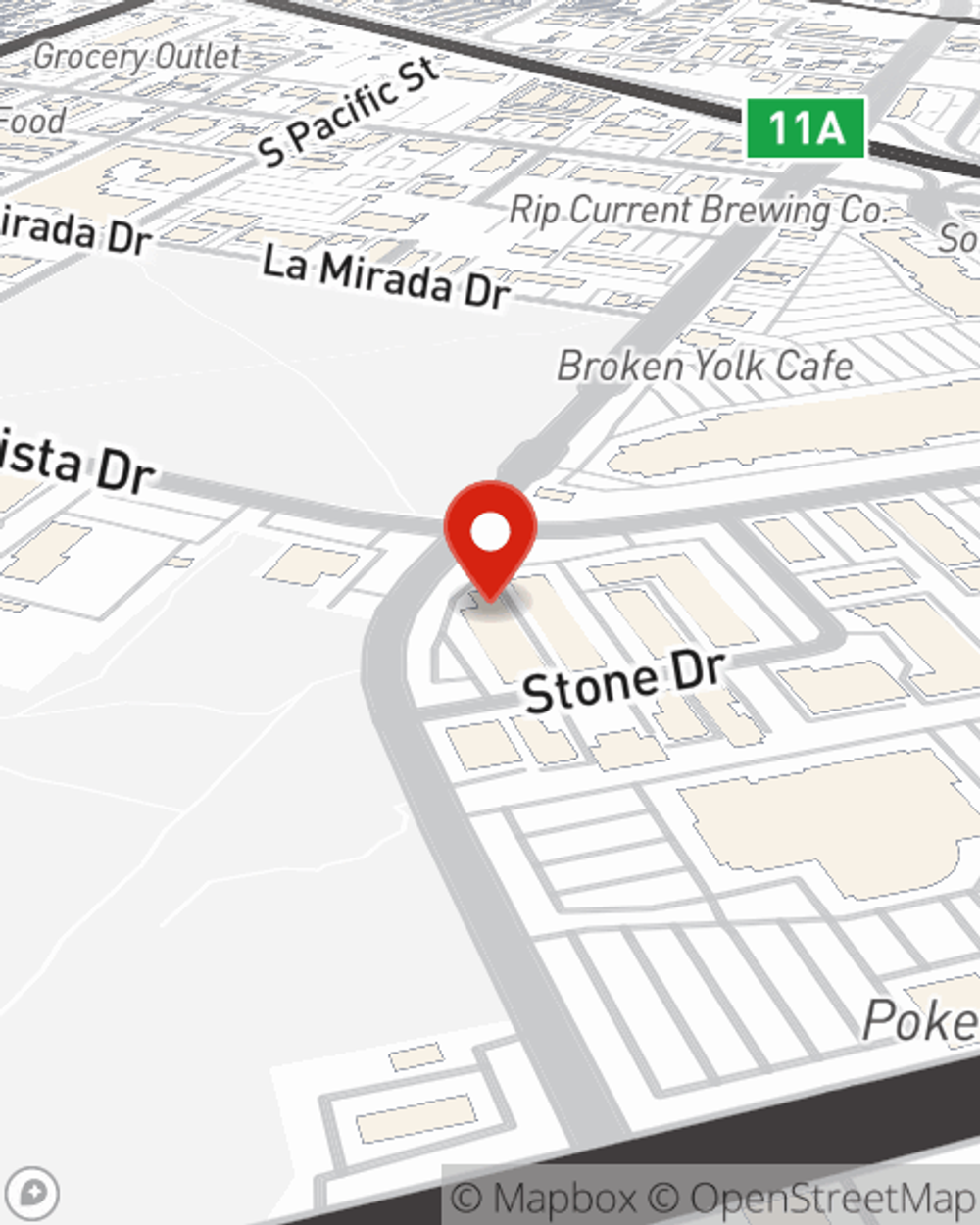

John Hadley

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.